Learning how insurance works takes some effort, but it’s vital to know the basic concepts of coverage to get what you need. Being aware of what’s available and how it works can have a major impact on the price you will pay to be covered. Armed with this knowledge, you’ll be able to choose the right policies that will protect your lifestyle, assets, and property.

At its core, the concept of insurance is very basic. When you have something to lose, and you can’t afford to pay for a loss yourself, you pay for insurance. By paying money every month for it, you receive the peace of mind that if something goes wrong, the insurance company will pay for the things you need to make life like it was before your loss.- When you buy insurance, you make payments to the insurance company. These payments are called “premiums.”

- In exchange for paying your premiums, you are covered from certain risks. The insurance company agrees to pay you for losses if they occur.

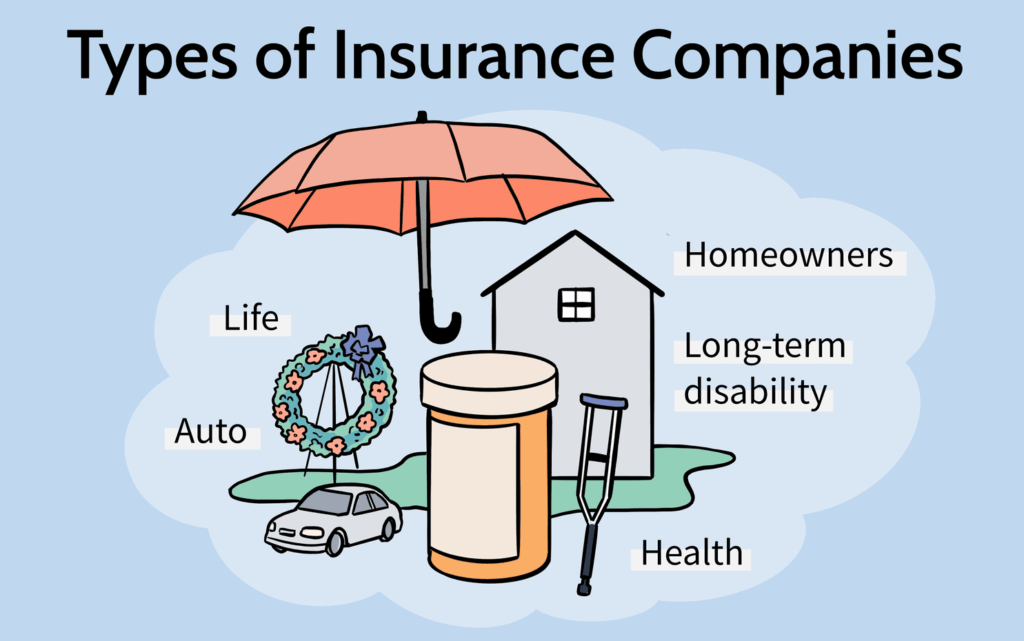

- You can buy many types of insurance, including auto, home, life, health, and disability insurance.

What Is Personal Insurance?

Personal insurance is any type of policy that isn’t commercial. You buy it to protect yourself from financial losses that you would not be able to afford to cover on your own. It relates to risks that you may face due to mishaps, illnesses, death, or damage to property you own.

How Does Insurance Work?

When you buy insurance, you make payments to the company. These payments are called “premiums.” In exchange, you are covered from certain risks. The company agrees to pay you for losses if they occur. Insurance is based on the idea that spreading the risk of a loss, such as a fire or theft, among many people makes the risk lower for all.

The insurance company has many clients. They all pay premiums. Not every client will have a loss at the same time. When a loss happens, they may get insurance money to pay for the loss.

Everyone does not have to buy it, but it is a good idea to buy insurance when you have a lot of financial risk or investments on the line. However, when third parties have a financial interest in the property, as is the case when a bank holds a mortgage, having insurance is typically required as a condition for approving the loan.

Note: Some insurance is extra, while other insurance, like auto, may have minimum requirements set out by law.

Why Does the Bank Require You to Be Insured?

Some insurance is not required by law. Lenders, banks, and mortgage companies will require it if you have borrowed money from them to make a purchase worth a lot of money, such as a house or a car.

To buy a car or house with a loan, you will need to have insurance on it. You will need car insurance if you have a car loan and home insurance if you have a home loan. It is often needed to qualify for a loan for large purchases like homes. Lenders want to make sure that you are covered against risks that may cause the value of the car or home to decline if you were to suffer a loss before you have paid it off.

Getting a Good Price on Insurance

The premium is the amount of money you will be charged by an insurance company in exchange for the financial protection provided to you by your policy. You may pay by the month, every six months, or once a year.

To lower your premium, shop around with a few companies or use a broker who can do the shopping for you. Find which company can give you the best rate by getting at least three quotes. Based on how claims are handled and the underwriting of the insurance company, the rates will vary.

Note: If you let your car or home insurance lapse, your lender will put their own insurance on it and charge you for it. This is not a good idea. Lender insurance is more expensive than the policy you would buy on your own.

Some companies may have discounts geared at bringing in certain types of clients. How well your profile fits the insurer’s profile will factor into how good your rate will be.

For example, if an insurer wants to attract younger clients, it may create programs that offer discounts for recent graduates or young families. Other insurers may create programs that give bigger discounts to seniors or members of the military. There is no way to know without shopping around, comparing policies, and getting quotes.

When Should You Buy Insurance?

There are three main reasons why you should buy it:

- It is required by law, such as liability insurance for your car.

- It is required by a lender, such as buying a home and getting a home policy.

- A financial loss could be beyond what you could afford to pay or recover from easily. For instance, if you have costly computer equipment in your apartment, you will want to buy renters insurance.

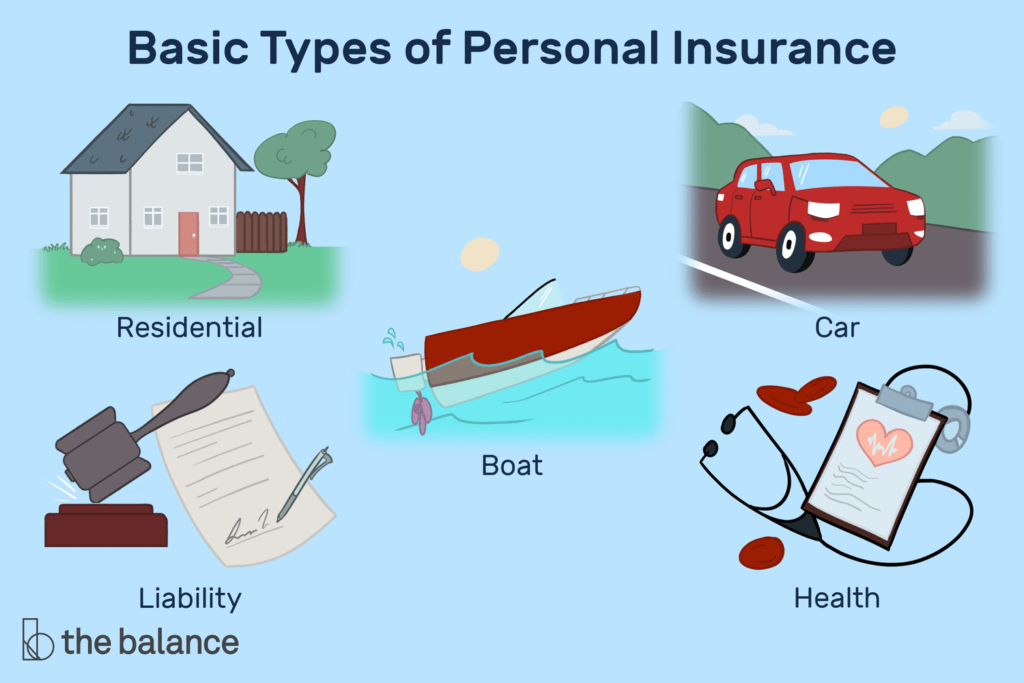

The 5 Basic Types of Personal Insurance

When most people think about personal insurance, they are likely thinking about one of these five major types, among others:

- Residential, such as home, condo or co-op, or renters insurance.

- Car insurance and coverage for other vehicles such as motorcycles.

- Boat insurance, which can be covered under home insurance in some circumstances, and stand-alone boat insurance for vessels of a certain speed or length that are not covered under home insurance.

- Health insurance and life and disability insurance.

- Liability insurance, which can fall into any of these groups. It covers you from being sued if another person has a loss that is your fault.

While you may be able to get some of your policies from one company, it’s not a guarantee. Insurance requires licensing and is divided into groups. This means that before someone is legally allowed to sell it or provide you with advice, they must be licensed by the state to sell and give advice on the type you are buying.

For instance, your home insurance broker or agent may tell you that they don’t offer life or disability insurance. They may be able to refer you to an agent in their circle with the proper licensing to sell you a policy.

Note: If you’re able to purchase more than one kind of policy from the same person, you may be able to “bundle” your insurance and get a discount for doing so.

What Does a Residential Policy Cover?

Homeowners insurance covers the buildings on your property. This includes your main dwelling along with any other structures in the space. It also covers the contents of your dwelling, movable property kept at your home, living expenses if you need to vacate your home after a loss, and liability protection.

Renters insurance covers your property kept in your rental unit as well as living expenses for vacating your home in the event of a loss. It also covers personal liability in your home and worldwide.

Condo or co-op Insurance is similar to renters insurance. In addition to your personal property, living expenses, and liability, it also covers some things that are very specific to owning a unit or shares in a building.

Note: It is always important to check the fine print of your insurance policy, as not all policies are created equal.

Car, Boat, and Other Vehicle Insurance

Car, boat, and other vehicle insurance offer many options in what is covered. The most basic is liability insurance. This covers your liability for your ownership or operation of the vehicle or vessel. There are also extra coverages you may purchase, such as ones for damage to the vehicle or vessel itself, and its parts. Options for medical payments to others, and death benefits due to death or injury resulting from the operation of the vehicle, may also be included as extra or mandatory, depending on state financial-responsibility laws or minimum car insurance requirements.

Health, Life, and Disability Insurance

Health, life, and disability insurance and other less-common types, such as long-term care, all provide coverage that will pay you for health-, illness-, or death-related events.

Health insurance includes many types of policies. You can find basic health benefits along with other health policies like dental or long-term care. There is a vast range of insurance types you can find to suit your needs.

How to Read the Small Print in Insurance Policies

Your insurance declaration page lists and describes the basic limits of what coverages you have paid for in the policy. The policy wording is the final word on how your insurance works in a claim. Most people do not read the small print in their policy. That is why some people end up confused and upset when they have a claim that doesn’t seem to be going their way.

7 Insurance Policy Terms to Know

These are some key phrases that you will find in the small print of your policy. It pays to know what they mean.

- The deductible is the amount of money you will pay in a claim. The higher your deductible, the more risk you take on, but your payments will be less. Some people choose a high deductible as a way to save money.

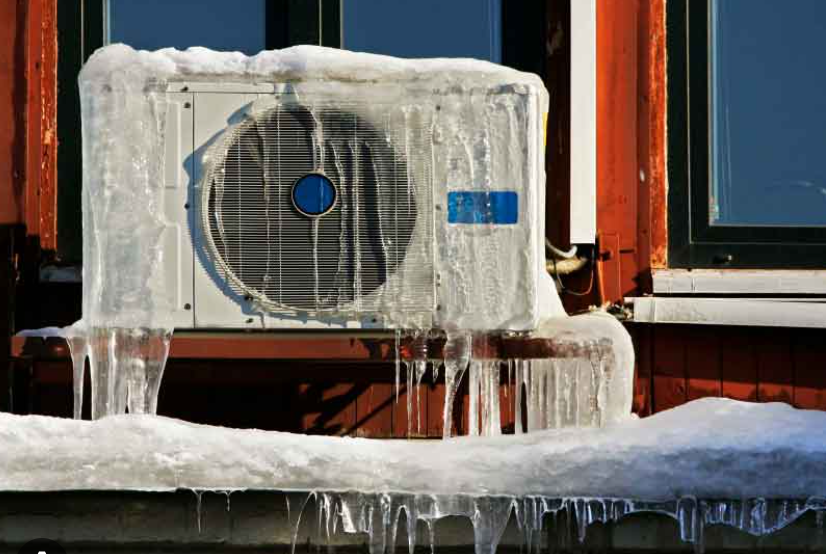

- Exclusions are not covered as part of your policy. It is vital to ask about the exclusions on any policy you purchase so that the small print doesn’t surprise you in a claim.

- Type of Policy: Companies offer various levels of coverage. If you get a really low price on a quote, you should ask what type of policy you have or what the limits of it are. Compare these details to those in other quotes you have.

- Special Limits: Policies all contain certain sections that list limits of amounts payable. This applies to all kinds of policies from health to car. This becomes urgent when you are making a claim. Ask about what coverages are limited and what the limits are. You can often ask for the type of policy that will offer you higher limits if the limits shown in the policy concern you.

- Waiting Periods and Special Clauses: Some types of insurance have waiting periods before you will be covered. For instance, with dental, you may have a waiting period. With life, you may be subject to a contestability period. These are just two examples. You always want to ask when you will start being covered. You should also ask if there are any waiting periods or special clauses that could affect what you’re covered for when you buy a new policy.

- Endorsements are add-ons to a policy to get more coverage. In some cases, they may amend a policy to reduce or limit what is covered.

- Basis of Claims Settlement represents the terms under which the claim will be paid. With home insurance, for instance, you could have a replacement cost or actual cash value policy. The basis of how claims are settled makes a big impact on how much you get paid. You should always ask how claims are paid and what the claims process will be.

How Do Insurance Companies Pay Claims?

When you have a loss such as a car crash or house fire, you will call your insurance company right away and let them know. They will record your claim and look into it to find out what happened and how you are covered. Once they decide you have a covered loss, they may send a check for your loss to you or perhaps to the repair shop if you had a car crash. The check will be for your loss, minus your deductible. You will pay that out of your own pocket.

Do You Get a Refund if You Don’t Make a Claim?

When you pay for insurance for many years, you may start to wonder why you’ve been paying so much when you have never had a claim. Some people may even feel like they should get their money back when they haven’t had a claim. That’s not how it works. Insurance companies collect your money and put it aside for payouts when there are claims.

This is the concept of “shared risk”. The thought is that the money paid out in claims over time will be less than the total premiums collected. You may feel like you’re throwing money out the window if you never file a claim, but having piece of mind that you’re covered in the event that you do suffer a significant loss, can be worth its weight in gold.

Premium vs. Claims Payments

Consider this example to help you see how premium and claims payments differ.

Imagine you pay $500 a year to insure your $200,000 home. You have 10 years of making payments, and you’ve made no claims. That comes out to $500 times 10 years. This means you’ve paid $5,000 for home insurance. You start to wonder why you are paying so much for nothing. In the 11th year, you have a fire in your kitchen, which must be replaced. The company pays you $50,000 to get your kitchen fixed.

If the insurance company gave everyone back their money when there was no claim, they would never build up enough assets to pay out on claims. Even the $5,000 you paid them over 10 years doesn’t cover your $50,000 loss. If you have even one loss, you become unprofitable to the company. Because insurance is based on spreading the risk among many people, it is the pooled money of all people paying for it that allows the company to build assets and cover claims when they happen.

What Makes Insurance Rates Go up or Down?

Insurance is a business. Although it would be nice for the companies to just leave rates at the same level all the time, the reality is that they have to make enough money to cover all the potential claims their policyholders may make.

When a company tallies up how much they paid in claims at the end of the year vs. how much they got in premiums, they must revise their rates to make money. Underwriting changes and rate increases or decreases are based on results the insurance company had in past years.

Note: Depending on what company you purchase it from, you may be dealing with a captive agent. They sell insurance from only one company. A broker offers insurance from many companies.

What Are Agents, Captive Agents, and Insurance Brokers?

The frontline people you deal with when you purchase your insurance are the agents and brokers who represent the insurance company. They will explain the type of products they have.

The captive agent is a representative of only one insurance company. They a familiar with that company’s products or offerings, but can not speak towards other companies’ policies, pricing, or product offerings.

An insurance broker or independent agent may deal with more than one company on your behalf. They will have access to more than one company and must know about the range of products offered by all the companies they represent.

How to Decide What Coverage You Need

There are a few key questions you can ask yourself that might help you decide what kind of coverage you need.

- How much risk or loss of money can you assume on your own?

- Do you have the money to cover your costs or debts if you have an accident? What about if your home or car is ruined?

- Do you have the savings to cover you if you can’t work due to an accident or illness?

- Can you afford higher deductibles in order to reduce your costs?

- Do you have special needs in your life that require extra coverage?

- What concerns you most? Policies can be tailored to your needs and identify what you are most worried about protecting. This may help you narrow down the kind of policy you need and reduce your costs.

Choosing a Policy Based on Your Current Lifestyle and Life Stage

The insurance you need varies based on where you are at in your life, what kind of assets you have, and what your long term goals and duties are. That’s why it is vital to take the time to discuss what you want out of your policy with your agent. Finding the right insurance products is a strong way to manage your money. It will help you remain financially safe even when you have a covered loss.

Frequently Asked Questions (FAQs)

How does FDIC insurance work?

The federal government created the Federal Deposit Insurance Corporation (FDIC) in 1933 to help strengthen the financial system. FDIC insurance will reimburse deposits in case of bank failure. If you bank with an FDIC-insured institution, your money is safe (up to $250,000 per depositor per institution), regardless of what happens to the bank.

What is gap insurance?

Guaranteed auto protection (“gap”) insurance is a type of auto insurance for those who finance their purchase. If you take out a loan to buy a car, and then something happens to the car, gap insurance will pay off any portion of your loan that standard auto insurance doesn’t cover. Some lenders require their borrowers to carry gap insurance.

Discussion about this post